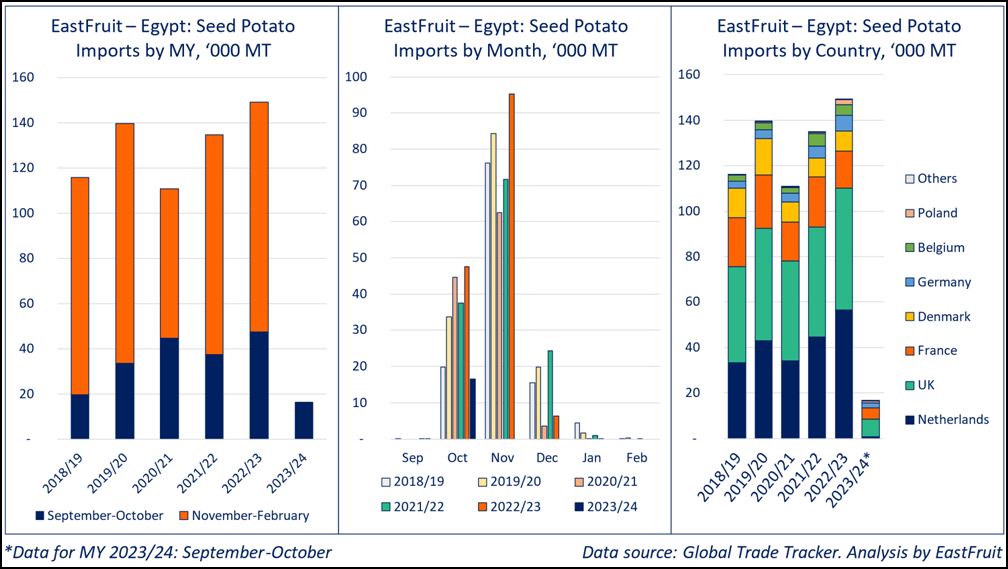

Egypt’s seed potato imports in September-October 2023 reached only 16.6 thousand tons, the lowest level in the past six years, reports EastFruit. This was a dramatic decrease from the same period of the previous season, which typically lasts from September to February.

“The first two months of autumn 2023 suggest that Egypt may import the smallest amount of seed potatoes in at least six past seasons. This could negatively affect the yield and export of ware potatoes from Egypt in the next marketing year 2024/25, as the market for ware potatoes is influenced by the lagged effect of seed potato imports,” comments Yevhen Kuzin, Fruit & Vegetable Market Analyst at EastFruit.

Egypt is one of the world’s top growers and exporters of potatoes: in 2022, the country ranked 12th in the global production of this product and was its sixth largest exporter in the world. Meanwhile, Egypt is also the second largest global importer of seed potatoes after Belgium, and seed potato imports play a vital role in the structure of Egypt’s local production.

Every autumn and winter, Egypt imports from 110 to 150 thousand tons of seed potatoes, which are used for multiplication in local conditions and production of ware potatoes in the following season. Therefore, a sharp decline in seed potato imports in the current season could lead to significant problems with the availability of high-quality ware potatoes as early as December 2024.

“The decline in seed potato imports in Egypt is partly due to the economic problems in this country, such as the devaluation of the pound and the shortage of foreign exchange reserves. However, in September 2022-February 2023, imports of seed potatoes in Egypt were record-breaking despite all the problems. Moreover, Egyptian exporters in 2023 were able to make a good profit on the export of table potatoes, so the financial factor is definitely not the main one. The key reason for falling imports is the deficit of seed potatoes in the EU in 2023,” explains Yevhen Kuzin.

According to NEPG (North-Western European Potato Growers Foundation), the reduction of areas under seed potatoes in EU’s main producing countries, as well as problems with the quality of tubers, may lead to a fall in their production by almost 20 percent in the current season. In the future, this will not only affect production of ware potatoes in the countries that depend on seed imports from the EU, but also in the European Union itself. In addition, it will be difficult to compensate for the shortage of ware potatoes in the MY 2024/25 by importing, for example, from Egypt.

Egypt is the largest exporter of ware potatoes to the EU, and the season of Egyptian exports coincides with the second half of the European potato campaign (February-July). In 2023, Egypt exported a record 440 thousand tons of potatoes to the EU countries, but even this volume did not lower the prices on the European market.

“All this in aggregate already leads to the preliminary conclusion that potato prices may be high in many European countries for the third season in a row, i.e. in MY 2024/25. However, it is still too tentative, as much will depend on the weather conditions in the summer of 2024 and potato market environment at the end of the current season.

As for Egypt, local exporters will be able to partially replace the shortage of imported seed potatoes with local produce, but the volumes of high-quality ware or processing potatoes may still decrease significantly. On the other hand, the loss in volumes may well be offset by high prices for the final products in the importing countries in the second half of the MY 2024/25,” concludes Yevhen Kuzin.