(Editor’s Note: Resnick wrote this article prior to the cargo ship colliding with the Francis Scott Key Bridge in Baltimore. Baltimore is an important U.S. port but the long-term ramifications of the port being closed were unknown at this posting.)

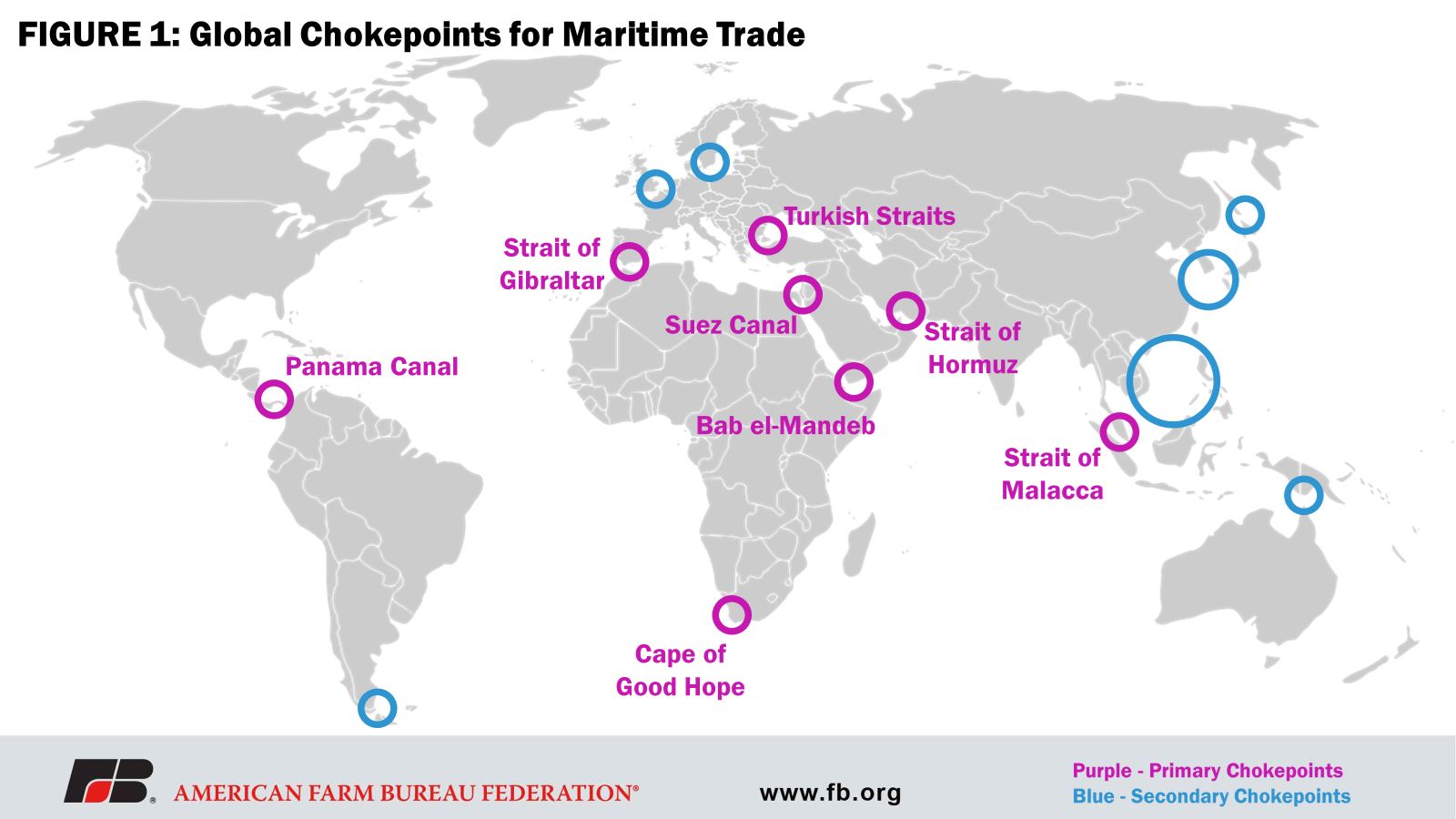

An estimated 80 percent of world trade is transported via ship. Maritime trade is most vulnerable to disruption at a series of geographic chokepoints across the globe (Figure 1). Some chokepoints are human-built canals, which provide extremely valuable shortcuts to connect the world’s oceans, and others are naturally narrow points between bodies of water.

In recent months, water level issues at the Panama Canal and attacks by Houthi rebels in the Red Sea, specifically around Bab el-Mandeb, have severely limited trade through two of the world’s most important passages. This Market Intel does a deep dive on these twin issues, which have compounded to create major headaches for global trade.

Water Woes At The Panama Canal

The Panama Canal connects the Atlantic and Pacific oceans and is the most important chokepoint for U.S. trade, with approximately 14 percent of all U.S. maritime trade transiting through the canal. In fiscal year (FY) 2023, 72.2% of cargo by weight transiting the Panama Canal was either originating from or destined for the United States. As a significant portion of bulk U.S. agricultural exports are shipped down the Mississippi River, through the Gulf of Mexico and on to East Asia, the Panama Canal is an essential transit point for U.S. agricultural products.

In fiscal year/marketing year 2023, roughly 91 percent of U.S. sorghum exports, 29 percent of U.S. soybean exports and 18 percent of U.S. corn exports transited through the Panama Canal (calculated using Panama Canal Authority data for Atlantic to Pacific cargo (October 2022–September 2023) and USDA Production, Supply and Distribution export data (September 2022–August 2023)).

Figure 2 illustrates why this is such a popular route. For goods being shipped from New Orleans to Tokyo, the Panama Canal route is 57 percent shorter in terms of distance than going through the Red Sea and 71 percent shorter than going around the Cape of Good Hope. At an average of 12 knots (without delays), the Red Sea route takes an extra 18 days on the water as compared to the Panama Canal route, and the Cape of Good Hope route takes an additional 22 days.

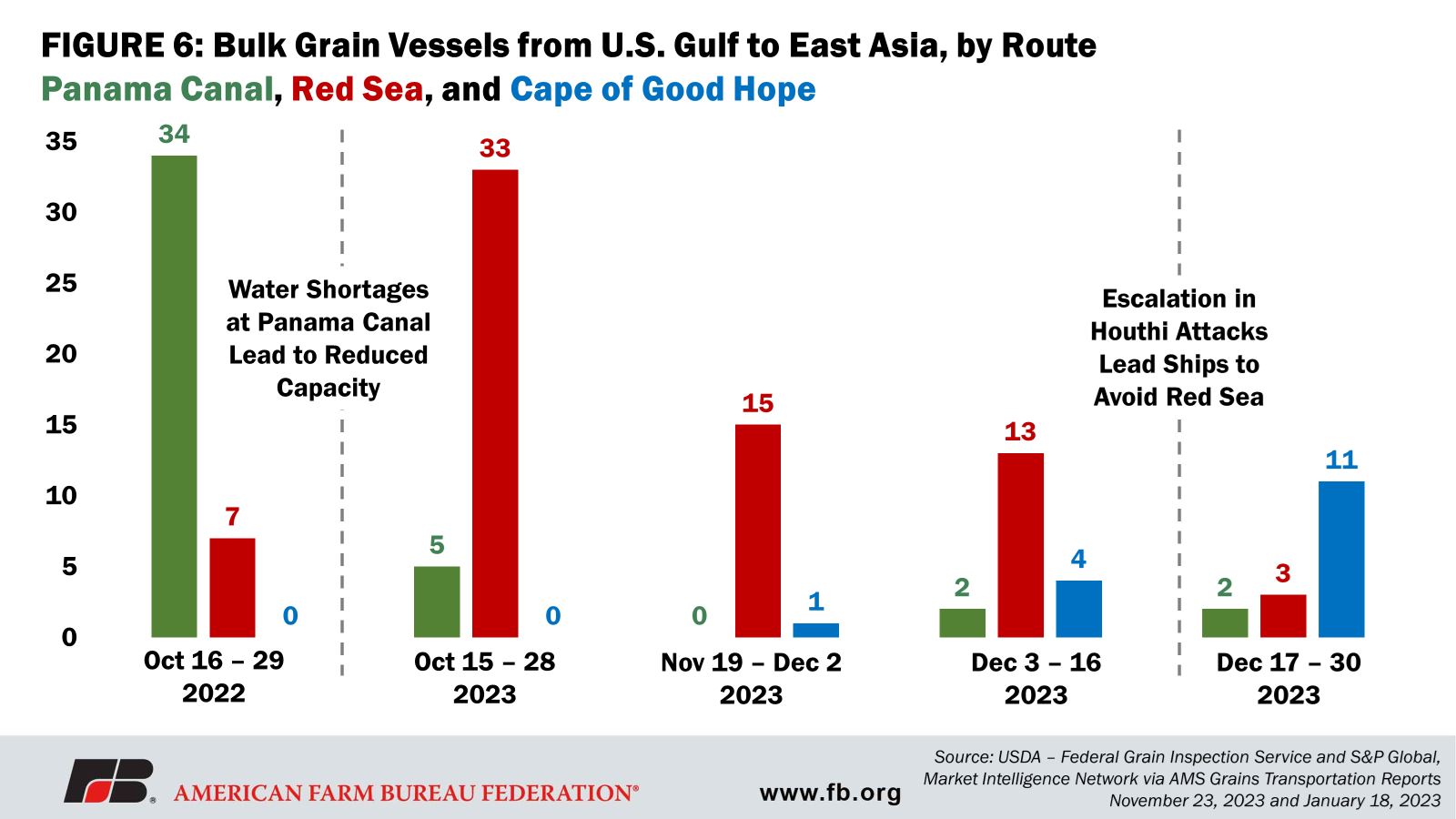

Time is money when it comes to transit – with each additional day requiring extra fuel costs, crew and labor wages, and tying up cargo space generally, which all drive up costs for ag exporters. For these reasons, in the latter half of October 2022, a period when maritime trade was running smoothly, 80 percent of grain exports headed out of the U.S. Gulf to East Asia were transported via the Panama Canal (USDA Agricultural Marketing Service Grain Transportation Report, Nov. 23, 2023).

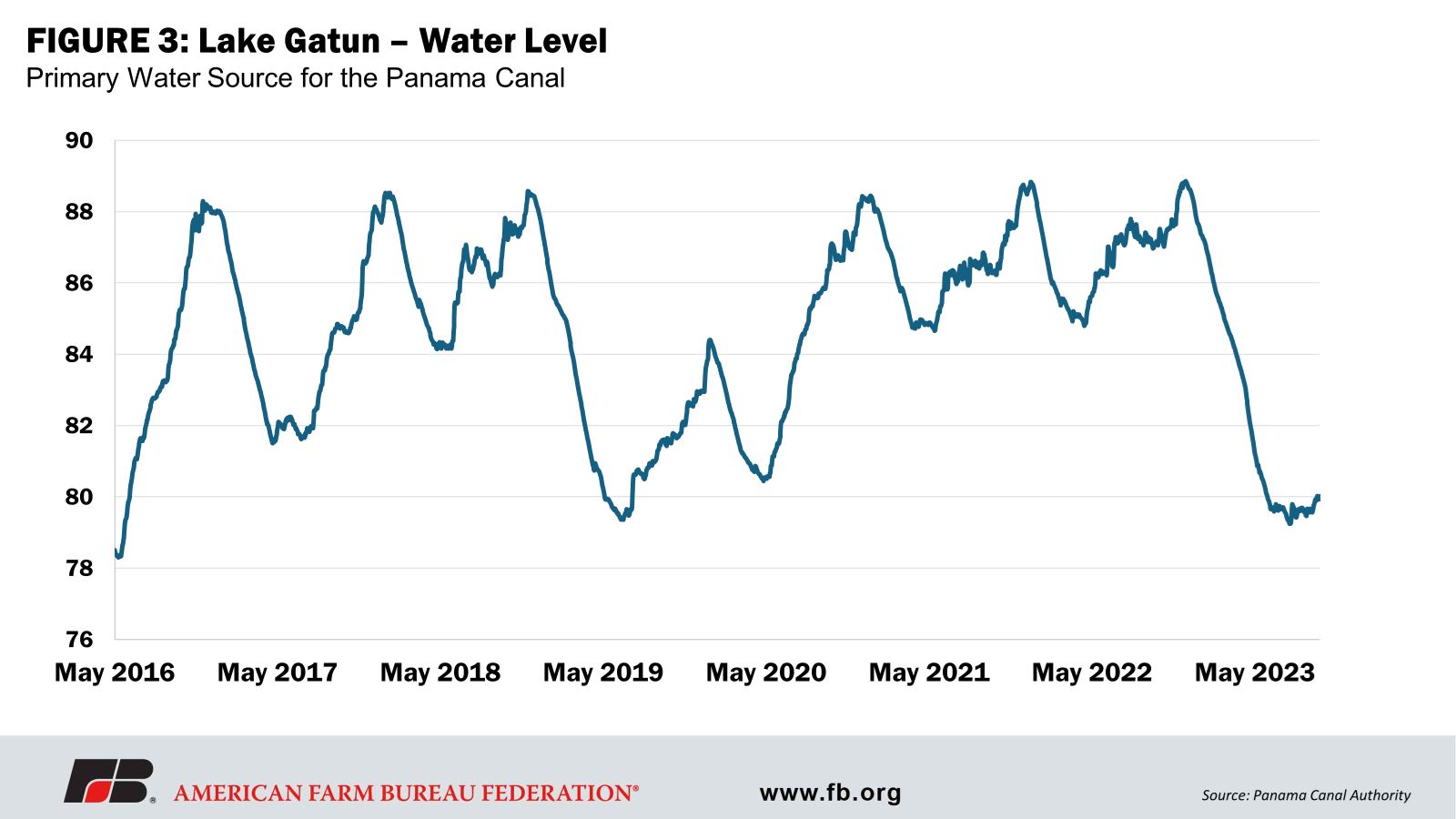

Now that the importance of the Panama Canal is established, we must dive into how and why low water levels are limiting exports through the canal. In a typical year, Panama’s rainy season lasts from approximately May through November. Due to impacts from El Niño, a climate phenomenon of unusually warm surface waters in the Pacific Ocean that disrupts typical global weather patterns, 2023 was the second-driest year in the Panama Canal watershed in recorded history. Lake Gatun is the primary water source for both the Panama Canal and drinking water for a majority of the country’s population. As Panama essentially did not have its rainy season in 2023, as of January 2024, when the lake is typically at its peak water level, the level was at the ninth-lowest low in the past 60 years.

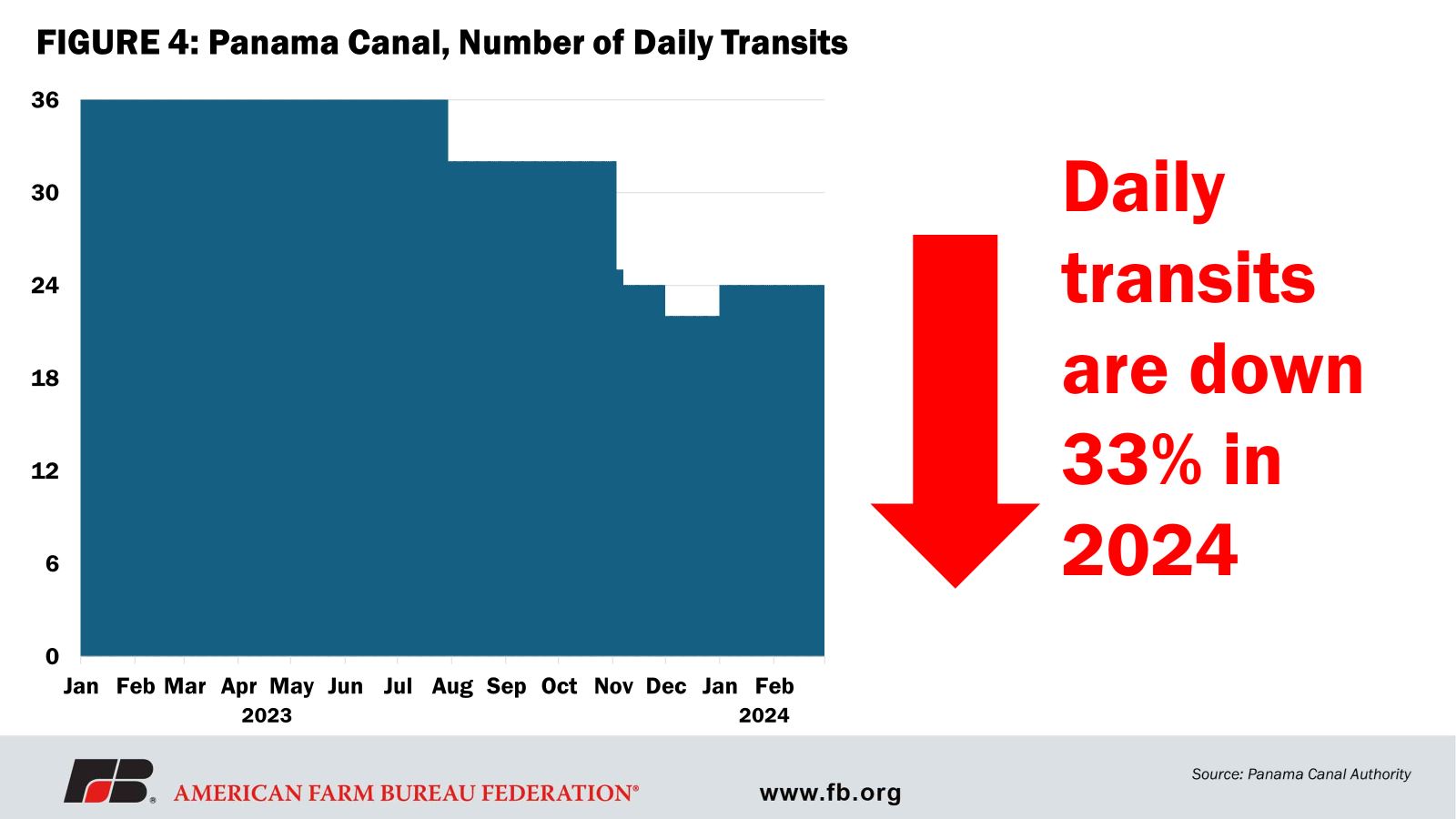

Operating the Panama Canal takes an immense amount of fresh water. For each transit through the canal, it takes an average of 52 million gallons of fresh water, or roughly 80 Olympic-sized swimming pools. Due to this unprecedented water shortage, the Panama Canal Authority has had to take unprecedented action. At the end of July 2023, the Panama Canal Authority started dramatically decreasing the number of daily transits allowed, settling at a reduction of 33 percent from 36 to 24 daily transits since January 2024 (Figure 4).

The daily transit restrictions are in addition to limits on draft height, which also severely restrict the amount of cargo the canal can move, a familiar problem to farmers due to low Mississippi River levels in recent years. Additional water saving techniques such as cross filling the original locks have reduced the amount of water in an average transit by 45 percent to 28 million gallons. New, larger locks opened in 2016 also move cargo more efficiently – allowing double the amount of cargo as the original locks while recycling 60 percent of the water used.

In response, Maersk, the world’s largest shipper, has switched container shipments between Oceania and the Americas to utilize the Panama Canal Railway instead of the Panama Canal. This means they are unloading ships on one side of Panama, putting them on an 80-kilometer rail line that runs parallel to the canal, then reloading them on ships on the other side, a slow and costly endeavor. This is not feasible for dry bulk, which is how grains and other bulk agricultural commodities are shipped, making the impacts on agricultural goods more severe.

This caused U.S. grain exporters (Gulf to East Asia) to shift from going through the Panama Canal to transiting the Red Sea. By the last half of October 2023, 91 percent of grain exports from the U.S. Gulf to East Asia were headed through the Red Sea and only 9 percent went through the Panama Canal. By the second half of November, no U.S. bulk grain vessels were transiting from the U.S. Gulf to East Asia via the Panama Canal. Instead, 15 of the 16 vessels went through the Red Sea, and one around the Cape of Good Hope.

So, what is next for the Panama Canal? In the long-term, the Panama Canal Authority is considering building an additional reservoir to source fresh water for the canal and will invest $2 billion in water management improvements. In the short term, water-saving measures will continue to stay in place until water levels improve – which will not likely come until rains return late this spring.

Conflict In The Red Sea

Like the Panama Canal, the Red Sea accounts for a massive amount of global shipping. White House estimates state that the Red Sea accounts for nearly 15 percent of all global maritime trade, 12 percent of global maritime oil trade, 8 percent of global grain trade, and 8 percent of global liquefied natural gas trade. Since mid-November, commercial shipping has been targeted by attacks from Houthi rebels in the Red Sea and Gulf of Aden. The Houthis are a U.S.-designated terrorist organization that controls a significant amount of territory within Yemen that borders the Bab el-Mandeb, the passage on the southern end of the Red Sea that is only 18 miles wide at its narrowest point.

The Houthis have been attacking commercial ships indiscriminately since mid-November, totaling at least 48 attacks as of Feb. 27. On Dec. 18, the U.S. and a coalition of many countries announced Operation Prosperity Guardian to focus on security in the Red Sea. The U.S. and its coalition partners have subsequently responded with a number of attacks on the Houthis and have continued to shoot down Houthi anti-ship cruise missiles and drones. As of Feb. 27, the U.S. has struck over 230 targets in Houthi-controlled areas of Yemen.

While to date only a few ships have sustained serious damage, most notably a bulk carrier with tens of thousands of tons of fertilizer that is now at risk of sinking, marine war risk insurance premiums have increased significantly since the attacks began. High marine war risk insurance premiums are charged as a percentage of the overall value of the ship and its contents. Thus, the more expensive the ship and its contents – the more expensive it is to insure. For this reason, container ships, which may have cargo value reaching over a billion dollars, were some of the first to abandon the Red Sea as a route.

For ships containing less valuable cargo – including dry bulk ships carrying agricultural products – shipping companies are considering the cost of diverting around the Cape of Good Hope against the cost of increases in insurance.

Let’s say a dry bulk ship has a total insurable value of $100 million. Prior to the attacks, they would pay a 0.02 percent insurance premium to transit the Red Sea – or $20,000. Now that has jumped to upwards of 1 percent - or a cool $1 million. That is, if insurers are willing to underwrite the ship at all – which several insurers are no longer willing to do with ships affiliated with the United States, United Kingdom or Israel, which the Houthis have vowed to target. Container ships are much more expensive, often in the range of $250 million to $500 million dollars – and thus were some of the first ships to begin avoiding the Red Sea.

Impacts To Date

A comparison of cargo transiting the Suez Canal on Nov. 23 to the amount transiting on Jan. 24 shows that total bulk commodity shipping is down 31 percent, with most reductions starting in late December and decreasing further throughout January. Liquified natural gas (75 percent) and liquified petroleum gas (66 percent) are the most impacted, while dry bulk is also down 28 percent.

Ships transiting between Europe and Asia are the most affected, as going around the Cape of Good Hope can double their transit times. India is severely impacted, both from a trade perspective and because many maritime crews are from India, both of which are reflected in India’s strong naval presence in the region.

At an informal public hearing on Wednesday, Feb. 7, Federal Maritime Commission (FMC) Chair Daniel Maffai characterized current conditions in the Red Sea and Gulf of Aden as the “biggest impingement on freedom of the seas in decades.” Witnesses affiliated with the agricultural sector included representatives from the Agriculture Transportation Coalition and the USA Dry Pea & Lentil Council/the American Pulse Association. Pulses include dry peas, beans, lentils and chickpeas.

During the hearing, both representatives from agricultural organizations emphasized that some of the largest impacts on agriculture include the uncertainty on whether ships can make it to destinations in the Middle East, stating that while 20-30 percent price increases are not sustainable for the shipper – it’s even less sustainable if the cargo can’t make it to where you want it to go.

Food aid, which in addition to feeding the world’s most vulnerable people is an important export avenue for U.S. pulses, has been particularly impacted with shipments to destinations on the Red Sea grinding to a stop. According to the testimony, Djibouti, an important port destination for food aid to the region that sits opposite Yemen on the Bab el-Mandeb, is unable to receive many imports. The lack of food aid inflows threatens to further destabilize the region, which has multiple areas in Ethiopia and Sudan on the brink of famine.

At the FMC hearing, worries abounded on whether U.S. West Coast ports are prepared to handle great inflows of cargo volume as ships rapidly switch from the East to West Coast. Many witnesses pointed to mid-March as when congestion in some U.S. ports will increase and a potential lack of containers and equipment availability will occur.

Compounding Complications

It is hard to overstate how the impacts of the water shortages at the Panama Canal and the Houthi attacks in the Red Sea compound and amplify each other. To understand the impacts a bit better, we can compare the shipment routes of U.S. grain exports between the U.S. Gulf and East Asia at various points in time.

In the latter half of October 2022, when the Panama Canal was operating at full capacity, 83 percent of bulk grain vessels traveling between the U.S. Gulf and East Asia traveled through the Panama Canal and the rest went through the Red Sea. During the same timeframe one year later this figure had flipped, with 87 percent of the ships going through the Red Sea. By late November 2023, nearly all bulk grain ships were traveling through the Red Sea because of the reduced capacity at the Panama Canal. By the last half of December – when Houthi attacks in the Red Sea had escalated – 69 percent of ships were going through the Cape of Good Hope, 19 percent through the Red Sea, and only 13 percent through the Panama Canal. The percentage going through the Cape of Good Hope likely escalated as we entered 2024 and attacks against commercial ships have continued relentlessly.

For a more international perspective, the United Nations Conference on Trade and Development published an analysis of current impacts on trade stemming from the disruptions in the Red Sea, Black Sea and Panama Canal.

Conclusions

The crisis at the Panama Canal and in the Red Sea/Gulf of Aden are like fraternal twins. While not identical, together they double the trouble. The water shortages at the Panama Canal are reminiscent of recent year’s low Mississippi River levels and could become a recurring problem. In the medium-term, it should be resolved in April or May with the return of the rainy season in Panama.

The challenges in the Middle East present a problem with little end in sight. Even if the U.S. and its allies are able to eliminate the Houthi’s ability to harm commercial vessels – the problem of cheap drones and missiles are not going away. If not the Houthis themselves, future groups now have a blueprint on how to cause global supply chain issues with relatively low cost to themselves.

Agricultural products, even high-quality U.S. goods, are fundamentally a fungible commodity – meaning they are replaceable or mutually interchangeable. While U.S. agricultural products are less harmed than those from Europe, Brazilian exports are less harmed than U.S. products. As U.S. producers have seen competition with Brazilian farmers in international markets increase in recent years, these trade route complications are particularly ill-timed.

In a small silver lining, even as this chaos continues, supply chains are more resilient now in a post-COVID world and cargo costs are nowhere near COVID-related highs. Lessons learned from COVID, and additional cargo capacity that is coming online from COVID-timed boat building decisions, will continue to diminish the impact of these issues. However, at the end of the day, any increases to the cost of trade will trickle down to farmer’s pocketbooks in terms of reduced demand for U.S. commodities (i.e., lower prices) or increased cost of inputs, such as fertilizer.

(Resnick can be reached at bettyr@fb.org.)