The Canadian climate is not always friendly to the production of many fresh fruits and vegetables resulting in limited production during the winter months. However, growth in the greenhouse and vertical farming space, along with more output in traditional production of field fruit and vegetables, has resulted in more homegrown fruits and vegetables – and a lesser (though still prevalent) reliance on imports for consumption.

Stronger reliance on Canadian fresh fruit and vegetable production is a positive development for both producers and consumers given uncertain foreign production and trade.

A Wider Look At Canadian Food Production

It’s a trope we hear quite often: Canada – a nation blessed with an abundance of raw agriculture commodities – doesn’t have enough value-added capacity at home, that its raw materials are simply shipped out of country to be processed elsewhere, and that this is a missed economic opportunity. But is it true?

Let’s begin with this fact: in aggregate, Canada simply grows more agriculture commodities and produces more food than its population is capable of consuming. Agriculture is an export dependent industry. Let’s also not discount the current strength of the Canadian food and beverage manufacturing sector: it is the largest manufacturing sector in the country, accounting for over 19 percent of all manufacturing sales in 2023 and providing employment for over 300,000 people.

That said, the percentage of Canadian food products that are consumed within our borders has declined recently. At the beginning of the century, Canada produced about 80 percent of its own food needs; that number fell to 70 percent in 2015 and has maintained that level over the last decade. There’s more that can be done in this space, but the Canadian food industry is, in aggregate, on solid footing.

Reliance On Fresh Fruit And Vegetables Imports Is Declining

However, there are plenty of foods that we consume (e.g., fresh fruits and vegetables) that aren’t all manufactured (e.g., like bread and sausages). Here, we need to take a different approach to measuring our own domestic production capacity – and reliance (or lack thereof) with trade partners.

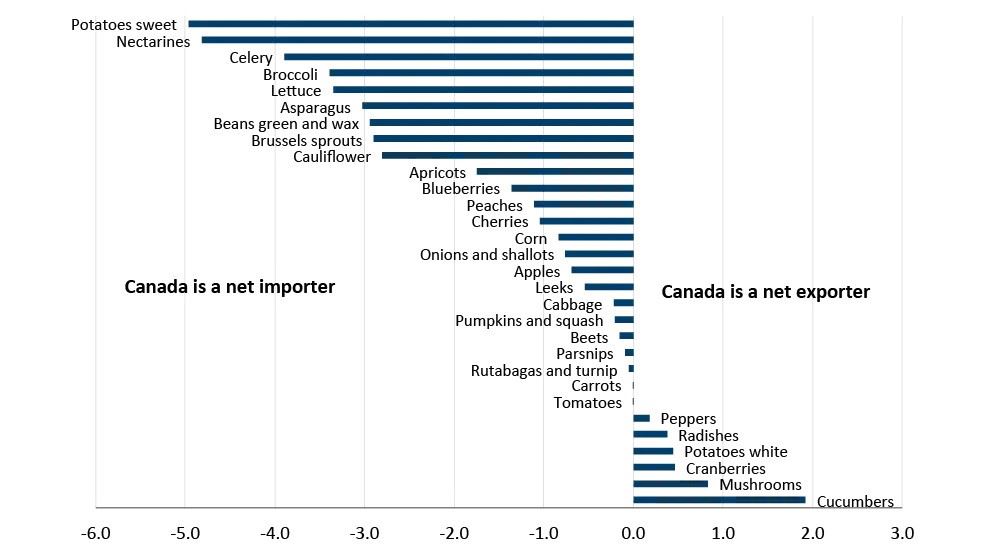

A trade dependence ratio measures a product’s dependence on trade using net imports and exports relative to overall consumption. A value of zero means Canada is self-reliant, as domestic production equals consumption. A negative value means Canada is a net importer, while positive values record a net exporting position.

For example:

- A value of -2 means that Canada’s net imports are two times larger than what it produces.

- Conversely, a value of +2 means that Canada’s net exports are two times larger than what it consumes.

When it comes to fresh fruits and vegetables, it’s no surprise that Canada is a net importer (Figure 1). There are very few fresh fruits and vegetables where Canada is a net exporter. There are also products not shown in the figure below where our production is extremely limited (e.g., peas, strawberries, pears, spinach, peaches) and thus are not shown.

Figure 1: Canada is a net importer of many fresh fruits and vegetables

Average ratios from 2021 to 2023. The data look at fresh produce only and thus exclude frozen and canned produce.

Sources: Statistics Canada, FCC Economics

In isolation, the results are not surprising, given the country’s climate and the comparative advantage other countries have in fresh fruit and vegetable production. However, it’s relevant to ask how Canada is performing today relative to the past and ask if it is becoming more or less self-reliant with respect to fresh fruit and vegetable production.

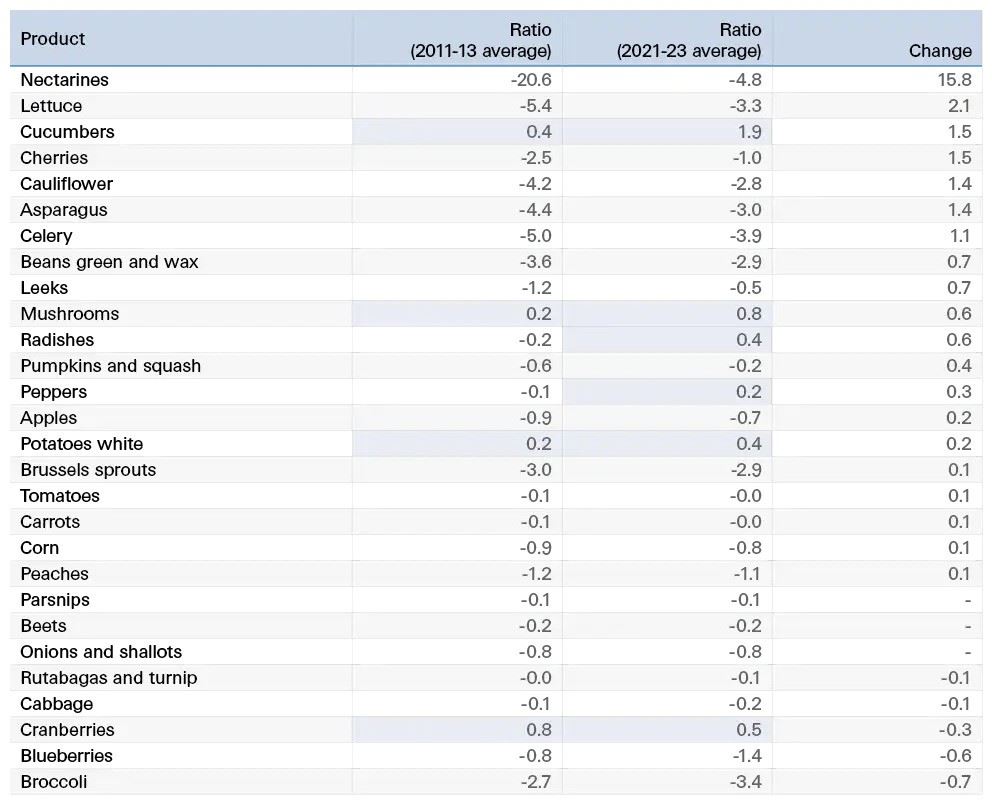

Here we look at how our trade dependence ratio has changed over time. Of the 28 products listed below, the ratio improved for 20 of them in the last ten years (Table 1). Only five products saw their trade dependence ratio deteriorate.

Table 1: Changes in fresh fruit and vegetable trade dependence ratio

Positive ratios (i.e., where Canada is a net exporter of a good) are highlighted in green. Sweet potatoes not included in the table because of no production data available 2011-2013. Apricots not included in the table because of no production data available in 2021.

Sources: Statistics Canada, FCC Economics

Although we are still a net importer for the majority of these fresh fruits and vegetables, our dependence on trade partners to get those commodities has diminished.

These ratios could be changing for a multitude of reasons: more or less production, more or less trade, more or less produce being diverted into other downstream products (e.g., frozen products, prepackaged salads), and/or more or less consumption. Take nectarines, for example, the product that had the best improvement in its terms of trade. Canadian production of nectarines has increased in the last 10 years, but imports have fallen by more than 50 percent as Canadian preferences changed and fewer nectarines are consumed today compared to 2011-13. Taken together, our dependence on nectarine imports has diminished, mostly due to declining demand.

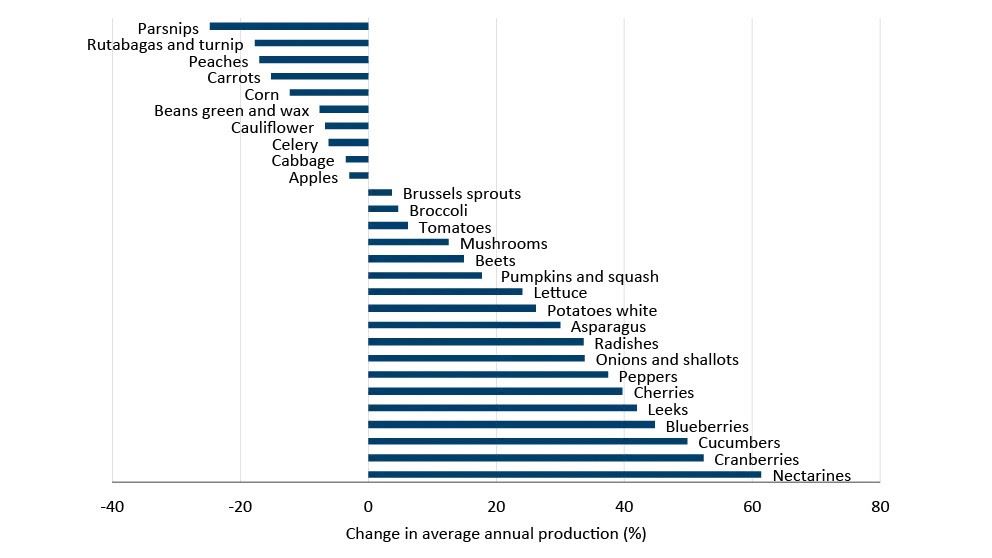

The good news, though, is that production has increased for many of these products (Figure 2). Much of the growth in production is by double-digits.

Figure 2: Changes in average production levels of select fresh fruits and vegetables

Change in average annual production between 2011-2013 and 2021-2023.

Sources: Statistics Canada, FCC Economics

Bottom Line

Despite the rhetoric that accompanies protectionist sentiment, trade is mutually beneficial on the whole. And the Canadian agriculture and food sectors are export-dependent, meaning free and open trade will remain important to the financial health of the industry. Pandemic-era supply chain constraints heightened awareness of the complexities of global logistics networks, and there are risks associated with having production of agricultural produce concentrated in only a handful of regions. Increased fruit and vegetable production at home should put Canada in a better position if/when future global supply chain disruptions arise and/or weather events disrupt production in the countries we import from. Despite weather-related production challenges at home in recent years the long-term outlook for the sector is positive.

Graeme Crosbie is a senior economist at FCC. His focus areas include macroeconomic analysis and insights and monitoring and analyzing Canada’s food and beverage industries. Having grown up on a dairy farm in southern Saskatchewan, he occasionally comments on the health of the dairy industry in Canada.

Graeme has been at FCC since 2013, spending most of that time in risk management. Graeme holds a master of science in financial economics from Cardiff University and is a CFA charter holder.